Know Where You Are Going

When I was a kid, my dad loved to get us all in the car on a beautiful summer day and go for a drive. This was back in the days before cell phones, so there was no GPS to guide us. We almost never had a map in the car, so we relied solely on only my dad’s sense of direction and his recollection of roads once traveled in some prior decade.

He would never tell us the specific destination of these drives, we simply got in the car and off we went, full of wonder and excitement about where this drive might take us. And then he would inevitably turn onto a road that would prompt one of us to ask, “Where does this road go?”

And he would reply, “It’s a shortcut.”We would then ask, “A shortcut to where?”

And he would only smile and say, “You’ll see.”

Sometimes his shortcuts took us to marvelous places such as a lake, an ice cream stand, a state park, or the house of a friend. However, just as many times, we would end up in a cow pasture, a corn field, a dead end, a gravel pit, or someone’s back yard. Truth be told, my dad never knew where these rides would take us, but for him the act of going on the drive was the part he enjoyed the most.

The point of my nostalgic tale is that if you don’t know, or care, where you are going, and all that matters is the act of taking a journey, then any road or “shortcut” will suffice. However, our jobs require us to be more planful.

To start your fiscal year off right, you need to know the goals are the metrics that leadership will be measuring to track their progress towards those goals. Goals for the entire fundraising team may be broken down into workplans for each front-line fundraiser, and you will need to know those goals as well. Ideally, results from prior years should be the drivers for setting these goals so that they are realistic and achievable, and goals are typically set by leadership.

However, the goals are set and whoever sets them – they dictate what this year’s focus will be. You must have goals in place to know where you are going.

Understand Where You Are Starting From

Your next step is to convert the goals to pathways for success for your fundraisers. Analyzing the current portfolios is the best place to begin: You can gain a sense of where your portfolios are. While keeping the fiscal year goals in mind, ask yourself several questions:

- Does the composition of this portfolio support this fiscal year’s goals?

- How can this portfolio be better positioned to achieve this fiscal year’s goals?

- Is there anything about this portfolio that would hinder achievement of this fiscal years’ goals?

To answer these questions, consider using pivot tables. These allow you to see the data in a more aggregated way by removing the personalization of who the data relates to.

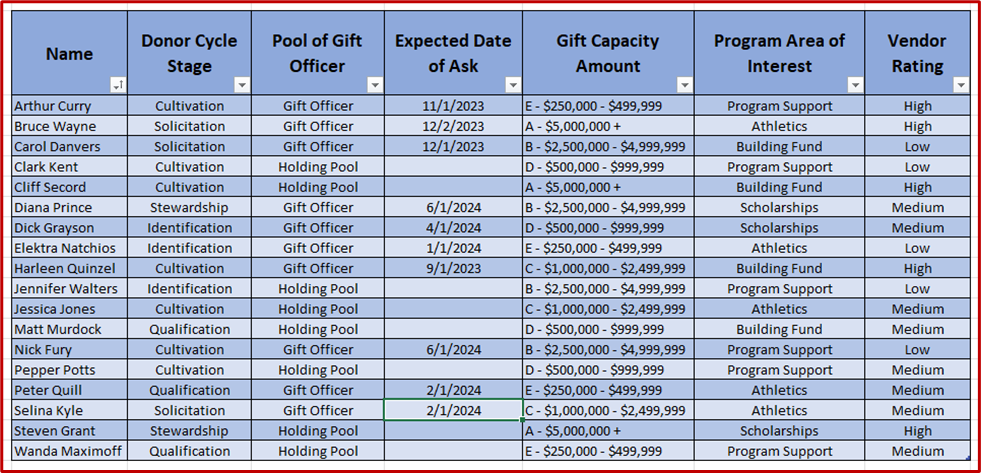

Illustration 1: The composition of current portfolio

By using pivot tables, you can gain insights into the current composition of a portfolio or prospect pool. With such insights, you can assess whether the current portfolios are able to support the fiscal year goals, and if not, you can adjust the portfolios that will help your fundraisers be more successful. See these examples, below.

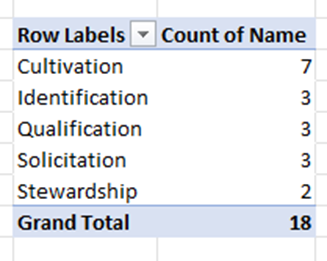

Illustration 2: Pivot table showing current portfolio broken down by donor cycle stages

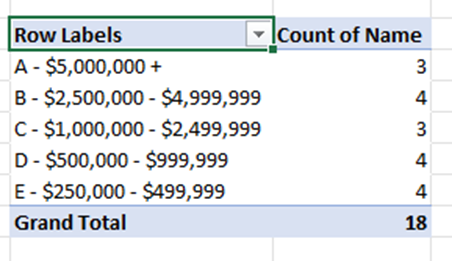

Illustration 3: Pivot table showing current portfolio broken down by gift capacity rating

In the sample portfolio above, we have a goal of 8 major gifts. We see that there are 3 prospects in solicitation currently, so we need to create a strategy to move 5 more prospects forward for asks. If the number of asks also is paired with a monetary goal, we would want to check whether there are enough prospects with the gift capacity ratings that would allow the fundraiser to achieve the monetary goal.

Create a Route for Success by Adjusting Portfolios to Align with Your Goals

A fiscal year goal could be to close a certain number of gifts, or to ask for a certain number of gifts, or to move a certain percentage of a portfolio into cultivation. Whatever the goals may be, there likely will need to be adjustments to the portfolio to allow a fundraiser to achieve those goals. If your fundraisers cover a certain area (geographic region, program area, etc.) you may need to work within those geographies as you adjust the portfolios.

Next, think about which prospects in the current portfolio do not need to be in an active portfolio any longer. As you move a few prospects out to annual giving, planned giving, or permanent stewardship – you are creating space to move some new prospects into a portfolio.

Many organizations have a holding pool, parking lot, or auxiliary pool. Whatever the naming convention is, this group of prospects has been identified as having capacity and yet they have not been assigned to a specific gift officer yet. This is where you may find new prospects to move into the portfolio, but make sure that these new prospects help to support the fiscal year goals for the individual fundraiser. Throughout the upcoming fiscal year as other prospects move out of a portfolio, more prospects will move in from that holding pool, so make sure to have your holding pool well prioritized so that you can seamlessly fill any voids in an active portfolio.

Creating Fiscal Milestone by Setting up Expected Asks Throughout the Fiscal Year

You can assume that there will always be a monetary goal for any given fiscal year. Understanding that there is a lot of work behind making an ask and securing a gift, you will want to assist your fundraisers by helping them pace out their asks throughout the fiscal year. With your fundraiser, look at the portfolio to see who is closest to an ask, and then pace out who might be the new few prospects who could be asked. You then create a tiered approach for askes throughout the fiscal year. The fundraiser will work with prospect management to ensure that they stay the course and keep the pace by always keeping those milestones in view and creating strategies to work towards achieving them.

Summary

By reviewing and preparing gift officer’s portfolios at the start of the fiscal year, you can help them by creating a roadmap for the fiscal year that will help them to achieve their goals in a strategic and efficient manner.

If you have thoughts or would like to share how your shop manages portfolios at fiscal year start, let me know at

Ruth@staupell.com.