Nonprofits are continuously combing through various lists of constituents in order to find those who will be the right prospects for a particular initiative. They may be looking for those who can make a certain sized gift, those who can give to a particular fundraising effort, those who may be able to step up their giving level, and those who might be able to become our major donors over time. Whatever the purpose is for this type of proactive prospecting, there also needs to be a strategy for how to approach the data in order to make informed decisions as to how to proceed. No fancy tools are necessary.

List Reviews

Proactive prospecting often takes the form of list reviews, and often those lists that get reviewed are the existing portfolio lists and, if an organization has such a thing, the holding pool list of those who are not in portfolios, but are being kept on a special list for some alternate reason.

Removing the Distractions

There are always prospects who are most well-known to an organization, through their generosity, the length of relationship with the organization, their service as a volunteer, their profession, or their having a big personality. Whatever the reason, these prospect names are known, and many of the associated facts and stories about that prospect come to mind easily when their name is seen on a list. While focusing on these prospects can be good in many ways, it also can distract from noticing other good prospects. Focusing on the tried-and-true invites bias, which can lead to missed opportunities. Sometimes we need to look to the less well-known constituents to find the prospects that we need to meet our fundraising goal.

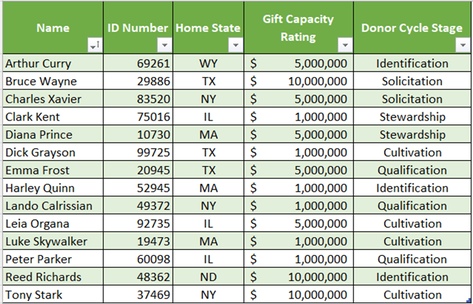

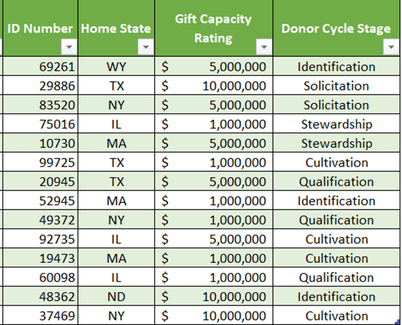

One tactic to help us reduce this bias is to remove names from the review list and let the data stand on its own. This is where hidden gems can rise to the surface because it allows us the opportunity to view groups or individuals that we might otherwise overlook to rise to the top. See this example of prospects with the names removed in order to reduce shiny object bias.

One tactic to help us reduce this bias is to remove names from the review list and let the data stand on its own. This is where hidden gems can rise to the surface because it allows us the opportunity to view groups or individuals that we might otherwise overlook to rise to the top. See this example of prospects with the names removed in order to reduce shiny object bias.

In a list review based on nameless data, the overlooked groups (perhaps these are the Millennials, Octogenarians, or those living in less interesting locations) also become more visible. As much as the well-known prospects are the bread and butter of any fundraising program, there also needs to be a pipeline of up-and-coming new prospects who can take their place when the well-known prospects bow out or age out. If we can find the up-and-coming new prospects early on, we can start the cultivation process immediately.

Prioritization of Prospects in a Portfolio

A list with the names stripped out, Excel, and a little pivot-table know-how will allow for some simple analysis of the data to find those overlooked and under-cultivated constituents in the lists, so that they can be prioritized and a plan for their cultivation and engagement can be created.

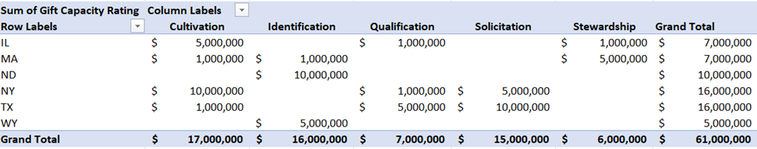

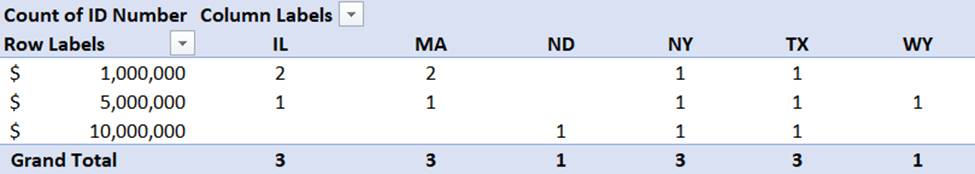

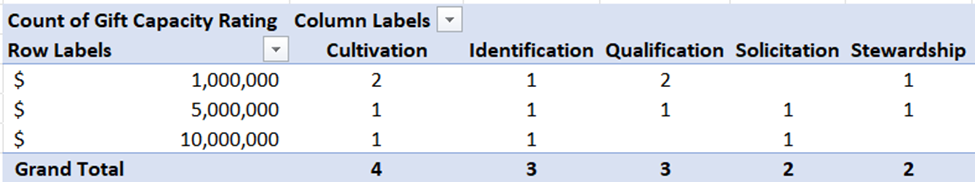

When a simple pivot table is created from the (made-up) sample above, a few interesting things begin to surface. For example, if the goal is to find the gifts that might be getting left on the table, look for areas where the gift capacity ratings are high but the prospect is still in the identification of qualification. In looking at the pivot tables below, based on the Excel data above, the most obvious question is “Who is the $10M rated prospect in North Dakota who is still in Identification, and is there a cultivation plan for that individual?”.

When a simple pivot table is created from the (made-up) sample above, a few interesting things begin to surface. For example, if the goal is to find the gifts that might be getting left on the table, look for areas where the gift capacity ratings are high but the prospect is still in the identification of qualification. In looking at the pivot tables below, based on the Excel data above, the most obvious question is “Who is the $10M rated prospect in North Dakota who is still in Identification, and is there a cultivation plan for that individual?”.

Table 1: Total Gift Capacity based on state and donor cycle stage

Table 2: Number of prospects per state by gift capacity rating

Table 3: Number of prospects per donor cycle stage by gift capacity rating

Summary

By removing the distraction of who we believe an individual to be, and letting the data tell the story, the bias around the top prospects for your organization becomes secondary to the story that the data tells about them. Use this data mining technique as a tool to allow the questions of “what” and “why” around each prospect before being distracted by the names. This technique can be used on portfolios, pools, or any group of constituents.

What do you do around identifying new prospects for your gift officer pools? How do you and your gift officers get unstuck from fighting over your best prospects? Feel free to share your thoughts with me.

What do you do around identifying new prospects for your gift officer pools? How do you and your gift officers get unstuck from fighting over your best prospects? Feel free to share your thoughts with me.